The Impact of Corporate Sustainability on Organizational Process and Performance

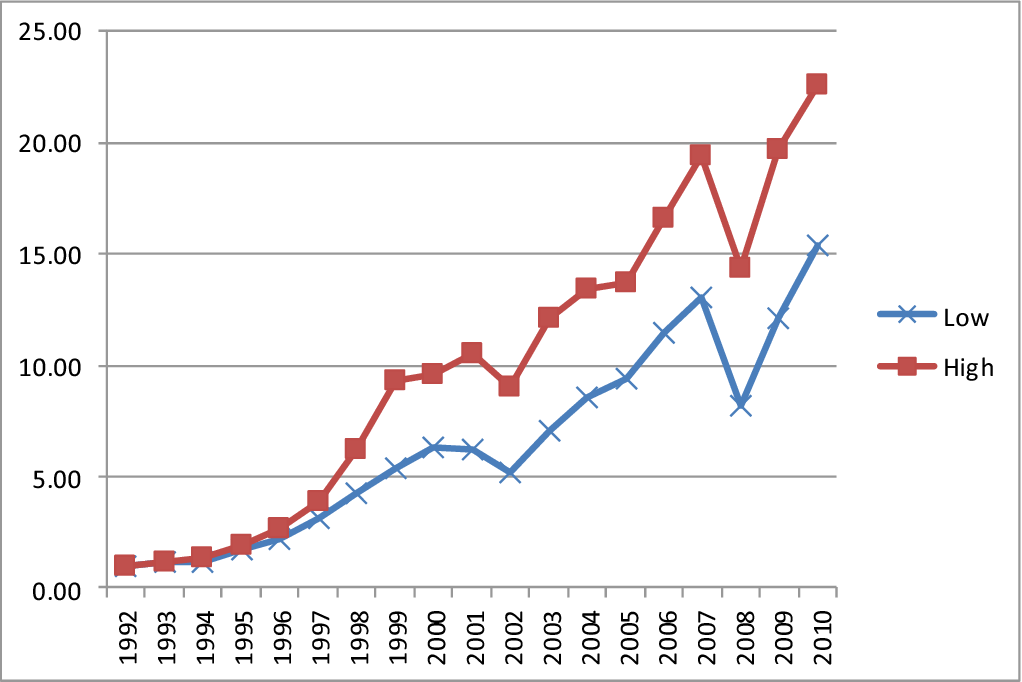

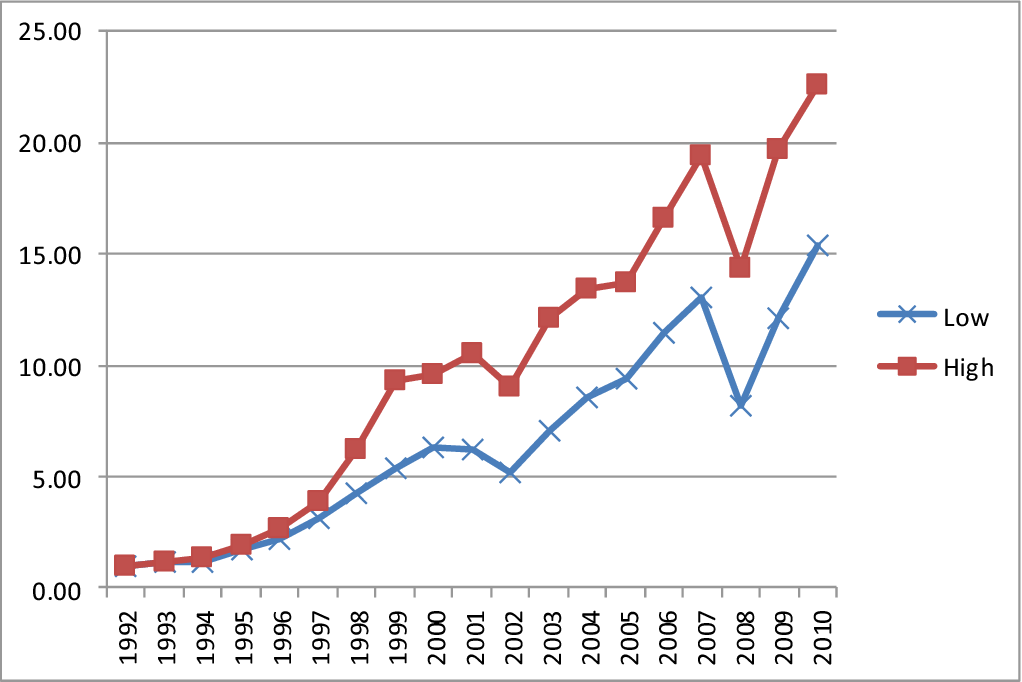

We investigate the effect of a corporate culture of sustainability on multiple facets of corporate behavior and performance outcomes. Using a matched sample of 180 companies, we find that corporations that voluntarily adopted environmental and social policies by 1993-termed as High Sustainability companies-exhibit fundamentally different characteristics from a matched sample of firms that adopted almost none of these policies-termed as Low Sustainability companies. In particular, we find that the boards of directors of these companies are more likely to be responsible for sustainability, and top executive incentives are more likely to be a function of sustainability metrics. Moreover, they are more likely to have organized procedures for stakeholder engagement, to be more long-term oriented, and to exhibit more measurement and disclosure of nonfinancial information. Finally, we provide evidence that High Sustainability companies significantly outperform their counterparts over the long-term, both in terms of stock market and accounting performance. The outperformance is stronger in sectors where the customers are individual consumers, companies compete on the basis of brands and reputation, and in sectors where companies’ products significantly depend upon extracting large amounts of natural resources.